“The preeminent Authority on the federal taxation of damage and settlement payments” – Lawrence Gibbs, Former IRS Commissioner

Listed #1 Best Lawyers for Tax Every Year Since 2006

Wood LLP provides comprehensive tax-related legal services, including taxation of legal settlements and judgments, tax audits and litigation, and federal, state, and international tax advice.

- Tax on Legal

Settlements/Judgments

- Tax Opinions and IRS Rulings

- Cryptocurrency Tax Matters

- Qualified Settlement Funds

- Tax Audits, Controversies,

and Litigation

- IRS Compliance and Collection

- Federal Tax Crimes

- Cryptocurrency Tax Matters

- Qualified Settlement Funds

- Sales, Mergers & Acquisitions

- Partnerships, LLCs, LLPs &

S Corporations

- Representing Company Founders

- Litigation Funding

- Federal, State & International

Tax Advice

- California and State Taxation.

- 1Estate Planning/Trusts & Estates

- Tax-Exempt and Nonprofit

Organizations

-Expert Testimony on Tax Matters

-

Litigation Support and Consulting

IRS Expert Witness Services

Wood LLP’s unmatched expertise and consistent recognition as the top tax law firm make us the clear choice for those seeking the very best in the industry. We have garnered recognition from leading organizations, industry experts, and top publications, solidifying our reputation as a trusted leader in the field

“The preeminent Authority on the federal taxation of damage and settlement payments” – Lawrence Gibbs, Former IRS Commissioner

“Rob Wood has done it again . . . Whether you practice on Main Street or Wall Street or someplace in between, you should have this book in your library or on your bookshelf.” – Lawrence B. Gibbs, former Commissioner of Internal Revenue,

Wood LLP has been named among America’s Best Lawyers by Forbes Magazine.

He is a Senior Contributor to Forbes, where he writes extensively on tax-related topics, providing insights into tax disputes, legal settlements, cryptocurrency taxation, and IRS compliance. In addition to his contributions to Forbes, Mr. Wood has authored over 30 tax books and regularly writes for other publications

The Wall Street Journal often quotes Mr. Wood for example in an article discussing the tax implications of J.P. Morgan’s $5.1 billion settlement, highlighting his expertise on the deductibility of legal settlements.

Mr. Wood as “The Section 104 guru,” a designation that The Wall Street Journal described as a “must read,” underscoring his authority in tax law

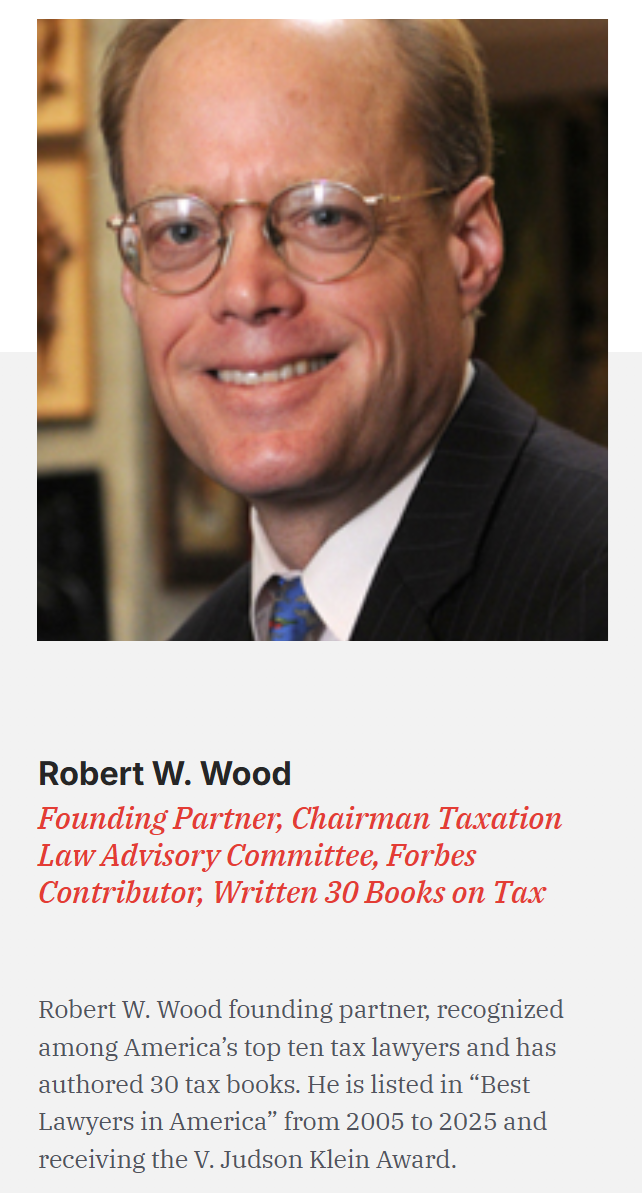

Robert W. Wood, managing partner at Wood LLP, has been consistently recognized among the top tax attorneys in the United States. He has been listed in Best Lawyers in America* annually since 2006. Additionally, Wood LLP has been ranked in the *Best Law Firms* by U.S. News. These accolades underscore the firm’s commitment to excellence in tax law.

Our Client-Centered Process

Founding Partner, Chairman Taxation Law Advisory Committee, Forbes Contributor, Written 30 Books on Tax

Robert W. Wood is consistently recognized among the top ten tax lawyers in America, celebrated for his unparalleled expertise in tax planning and controversies. Known for simplifying complex tax concepts, he is a trusted advisor to plaintiffs, defendants, lawyers, and settlement funds, particularly on the tax treatment of legal settlements and judgments. A prolific author, he has written numerous tax books and hundreds of articles, contributing regularly to Tax Notes, Forbes, and other esteemed publications. His thought leadership extends to frequent media commentary on tax matters.

Partner Tax Attorney, Harvard Alumnus, specializing in federal, state, and international tax matters.

Donald P. Board is a partner at Wood LLP, specializing in federal, state, and international tax matters for businesses and individuals. A Washington D.C. native, he earned his undergraduate degree from Harvard College and graduated magna cum laude from Harvard Law School, where he served on the Law Review. He also holds an LL.M. in Taxation from Boston University Prior to joining Wood LLP, Donald spent 15 years as a tax lawyer at a major international firm, focusing on tax-efficient mergers and acquisitions, business restructuring, securing innovative IRS rulings, and representing clients in disputes with tax authorities.

Partner specializing in federal and international tax planning and controversies.

Alex Z. Brown is a tax attorney at Wood LLP, specializing in federal and international tax planning and controversy for individuals and businesses. A Texas native, he graduated summa cum laude from Texas A&M University with a degree in Political Science and earned his J.D. from the University of Chicago Law School. He has significant experience in tax controversy, advising clients in IRS disputes involving amounts up to $100 million. Alex is a member of the State Bars of California, Maryland, the District of Columbia, and Texas (inactive).

He advises multinational corporations and high-net-worth individuals on complex tax issues, including debt/equity, partnership tax, economic substance, business purpose, and penalty abatement.

Jeff Wax handles complex tax controversy matters at the federal and state level and acts as a trusted tax advisor to major multinational corporations and high-worth individuals. Drawing on four decades of private sector experience, Jeff started his career with a national law firm and then transitioned to lead the tax controversy practice for a Fortune 50 multinational energy company. In 2000, Jeff joined a Big Four accounting firm and led its West Region Tax Controversy practice.

With over 15 years of experience, she has handled complex IRS examinations, appeals, audits, and settlements involving international and cross-border issues.

Her expertise spans state apportionment, unitary business analysis, and research and development tax credit defense. Colette advises clients on transaction planning, debt/equity matters, intellectual property migration, and cross-border royalty and interest payments. She holds a J.D. and LL.M. in Taxation from the University of Illinois Chicago School of Law, where she graduated at the top of her class and served as Candidacy Editor for the Journal of Computer and Information Law. She is a member of the State Bars of California and Illinois.

A brilliant tax attorney specializing in Federal and International Tax Matters international tax planning and controversy matters for individuals and business entities.

Tenzing N. Tunden is a tax attorney at Wood LLP, advising individuals and businesses on federal and international tax planning and controversy matters.

WOOD LLP

He holds an accounting degree from the University of Arizona, a J.D. from UC Davis School of Law, and an LL.M. in Taxation from NYU School of Law. His experience includes tax litigation, planning, and internships with the Franchise Tax Board and the U.S. Attorney’s Office.

Tax Attorney Specializing in Federal and State Tax Planning and Controversy

Daniel Krumbein advises individuals and business entities on a broad range of federal and state tax planning and tax controversy matters. Daniel received his law degree from the University of California, Hastings College of the Law with a concentration in tax. He received his undergraduate degree in Political Science with a minor in Spanish from the United States Naval Academy, graduating with honors and as a VGEP Scholar. He subsequently received Masters’ degrees in Public Affairs, Business Administration and International Relations from American University and Salve Regina University while serving as a Surface Warfare qualified Naval Officer.

Mina Schultz has been instrumental in supporting the firm's legal operations and publications.

Mina Schultz has been with Wood LLP since 2007, bringing extensive experience to the firm. She holds a Bachelor of Arts in Psychology from UC Berkeley and previously served as a general manager, developing strong leadership skills. As the Production Editor for The Wood LLP Tax Alert, she coordinates the publication of the firm’s books and periodicals, ensuring the dissemination of recent tax trends nationwide. Mina also contributes to articles for Tax Notes and bar association journals and edits legal treatises, significantly impacting legal and tax law literature. Her fluency in Korean and proficiency in Spanish enhance her ability to communicate with diverse clients.

Noah S. Geller, a Legal Assistant, graduated from Stanford University in 2023 with He co-founded Stanford's student chapter of the American Civil Liberties Union,

He graduated from Stanford University in 2023 with a B.A. in Philosophy, minoring in Mathematics and Computer Science. During his time at Stanford, Noah co-founded the university’s student chapter of the American Civil Liberties Union, focusing on First Amendment advocacy and chairing the Social Justice committee. He also held leadership roles in student arts organizations, including Mixed Company and Stanford Light Opera Company. Noah’s research experience includes analyzing astrophysics datasets and investigating California’s water policy.

Learn more about us…

Our team has over 40 years of combined experience in complex tax law matters

We focus exclusively on tax law, ensuring deep expertise in this complex field

We tailor our strategies to each client’s unique situation and goals.

Successful outcomes in high-stakes tax litigation and planning cases

Get FREE Expert Tax Consultation with Robert Wood, one of the top Tax Attorneys in the USA — Absolutely Free with No Obligation!

© 2024 Woodllp.com. All Rights Reserved

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.